Last week, we talked about the plan to unlock the value of DER and flexibility and what good progress towards having that plan might look like.

In this article, we move on to outline how the first step to unlocking the value of DER and flexibility is to take a flexibility-first approach to network operation and asset management. The operating instructions for networks have changed and/or are changing – the old ones were designed for a steady operating state. Moving to a flexibility-first approach is about embedding the necessary change to a dynamic operating state.

To be clear; without a flexibility-first approach, the brakes will be put on electrification, uptake of DER will stall and the electricity sector (and the economy generally) will find it much harder and much more expensive to meet its emissions reduction targets.

Network operators must explicitly commit to flexibility-first

Flexibility-first means networks – transmission and distribution – explicitly commit to a flexibility-first approach to network operation and asset management.

The idea and practice of flexibility from DER is most advanced in Great Britain. Over there, flexibility means someone ‘modifying generation and/or consumption patterns in reaction to an external signal (such as a change in price) to provide a service within the energy system’.

Flexibility is not your mother’s (or your father’s) demand response (DR). Traditional DR is and was from a centralised world of analog devices and averaged calculations. Flexibility is made for this world and the future that is rapidly emerging, which is digital and decentralised, where targeted, time- and location-specific behaviours will be needed for day-to-day efficient network operations and management.

The same concepts and terminology are being adopted in Aotearoa New Zealand. A useful glossary of concepts has been developed by the Innovation and Participation Advisory Group.

Flexibility is happening in the UK

Routine use of flexibility services in Great Britain started following a 2018 commitment by network operators to ‘opening up requirements for building significant new electricity network infrastructure to include smart flexibility service markets as part of day-to-day operations’.

The commitment was supported by OFGEM (and consumers) – the electricity sector regulator – in a range of ways, including through a £500M low carbon networks fund available between 2010-2015 to support network operators to try out new technology, operating and commercial arrangements. The 2015-2023 price control period also provided £70M a year (on a contestable basis) for projects which help all network operators understand how to provide environmental benefits, reduce costs, and maintain security of supply as Great Britain moves to a low carbon economy.

Flexibility services are now being procured by all electricity networks in Great Britain on a business as usual basis to help manage congestion (thermal constraints) on local networks by supplying an active power service through the use of load variation techniques, such as demand management, batteries and stand-by generators, which can meet the specified performance requirements.

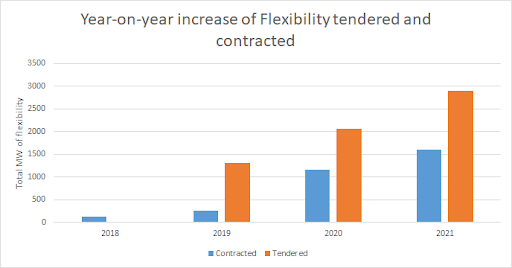

Liquidity of flexibility markets has increased a lot between 2018 and 2021.

According to the UK Energy Networks Association, flexibility services are “a relatively new market but one that has seen explosive growth over the past three years. Starting with 116MW of flexibility being contracted in 2018, this has increased 16-fold in those three short years to 1.6GW having been contracted to date in [July] 2021…”.

As a result, DER owners and sellers of flexibility services can realise more value from their investments.

Flexibility will not become routine anytime soon without upgrading our regulatory settings

The lesson here for Aotearoa New Zealand is that flexibility will only become routine if the Commerce Commission upgrades its regulatory settings (via the Input Methodologies and however else necessary) so that flexibility services are the first choice tool for ensuring network services are delivered according to reliability and quality thresholds.

Flexibility services from DER are not yet an everyday network management tool. Flexibility is seen as an option, and several distributors have actively considered or installed flexible options, for example Powerco (Whangamata battery energy storage system); Aurora Energy (Upper Clutha Non-Network Alternative ROI); and Vector (Glenn Innes battery energy storage system).

There is a chicken and egg problem – distributors do not see sufficient flexibility available to rely on, and see it as a not-quite ready yet solution; and flexibility suppliers don’t have sufficient certainty their capability will be used to underpin the required investment, and so cannot demonstrate flexibility can be relied on.

There are also problems with the regulatory settings which create a bias towards traditional asset management solutions. The fundamental problem is the regime is designed for a steady-state environment, not an everything-is-changing-but-we-cannot-really-say-how-state environment.

More incentives are needed

More incentives are needed for network operators to make flexibility services a preferred and routinely used network management tool.

As pointed out by the IPAG, existing regulatory settings do not provide sufficient incentives for efficient use of flexibility.

The input methodologies which specify the regulatory settings for determining the price and quality of distribution services need to provide more explicit support (via financial incentives or obligations) for network operators to do the extra work needed to evolve investment and operating practices to fully leverage the capability and value of DER and flexibility services. Similar encouragement is needed for the distributors only subject to information disclosure.

Experience from Great Britain indicates regulatory intervention is required – with changes to network regulation and market settings and funding – to overcome the coordination problems preventing access to the full value of DER (ie, emerging technologies). Even with the explicit support and dedicated funding, the Great Britain flexibility market has taken over 4 years to get to where it is.

There is a clear parallel with the evolution of generation and retail electricity markets. A key reason for the generator-retailer construct was the need to ensure there was ‘liquidity’ in the market. It is difficult to see why a similar intervention is not required to establish a liquid flexibility market. Expecting to rely on an organic ‘market-led’ outcome ignores the experience of over 20 years with the wholesale market.

Shifting to flexibility-first will involve a transition

The shift from existing asset management practice to a flexibility-first approach will require a transition. At a high level, the things the Commerce Commission will need to consider when upgrading the input methodologies for distribution and transmission are:

- How will asset management practices need to adapt to reflect security settings based on more just-in-time options for managing congestion and providing network capacity? What will a transition look like? Does it require a shift from deterministic to probabilistic planning criteria?

- What different investments will network operators need to make and how will these costs be recovered? How relevant are historical cost trends when the future operating environment will be very different to the past?

- How will network operators be compensated for research and development and market development risks? Will a loosening of reliability and quality thresholds be needed to provide network operators with the ability and incentive to experiment and learn new ways of doing things?

- What can households and businesses expect? How does the electricity sector explain the prospect of higher costs now to avoid even higher costs in the future? How does the electricity sector explain the prospect of variable reliability and quality of supply as things go wrong? (And they will.)

Flexibility-first must be the first step

Flexibility-first must be the first step by the electricity sector to accelerate electrification and decarbonisation.

This is the single-most potent catalyst for reaping the benefits ($7.1B!) of DER and flexibility services and making sure the electricity system and market is able to do its bit to support electrification and decarbonisation.

Urgency in upgrading the regulatory settings, particularly the input methodologies, to reflect a flexibility-first approach is critical. Not adopting a flexibility-first approach will result in a slower and higher cost transition to a low carbon economy, along the way compromising the opportunity for consumers to invest in solar, batteries, electric vehicles and electrification of space heating, and resulting in reduced system-wide reliability and resilience.

Next time

To be continued…in the next article, we will talk about making flexibility a feature of system and network operation.

Cortexo and Our Energy are committed to action that results in the electricity system and market being able to meet the challenges and opportunities of accelerated electrification.

We want to help lead the conversation about how, when and what the electricity sector needs to do to accelerate electrification and to show the way by trying things out.

To see what Our Energy and Cortexo are doing together to accelerate electrification you can have a look here